Where One Bad Turn Can Get Expensive

Travel insurance feels optional right up until the moment it doesn’t, which is usually the moment you’re standing in a pharmacy trying to translate a label, staring at a canceled ferry notice, or realizing the nearest decent hospital is not remotely nearby. Some places are forgiving if something goes sideways, because clinics are plentiful, transportation is easy, and rebooking is annoying but doable. Other destinations are beautiful precisely because they’re remote and logistically finicky, and that’s where a small problem turns into a big bill or a trip-ending scramble. The smartest way to think about insurance is not as a superstition purchase, but as a tool for trips where improvising would be painful. Here are 20 destinations where coverage tends to matter in a very real, very practical way.

1. Nepal’s Everest Region

Trekking near Everest is not inherently reckless, yet altitude is indifferent to your fitness plan and your itinerary. If acute altitude sickness hits hard, evacuation can mean helicopters, weather delays, and specialized care. Insurance that clearly covers high-altitude trekking tends to be the difference between a stressful situation and a financially brutal one.

2. Patagonia (Chile And Argentina)

Patagonia looks like it was designed for postcards and dramatic mistakes, with wind, distance, and long stretches where nothing much exists except road and sky. A twisted ankle on a trail can turn into a complicated transport problem, and weather can snarl flights and ferries for days. The region’s beauty comes with enough unpredictability that cancellation and medical coverage feels less theoretical.

1. Antarctica

Antarctica is stunning and also basically allergic to last-minute solutions, especially if someone gets sick or injured at sea. Operators often expect travelers to carry medical and evacuation coverage because the nearest help is far away and weather decides everything. When you’re days from a major hospital, even a routine issue can become a serious logistical project.

4. The Galápagos Islands (Ecuador)

The Galápagos are regulated, scheduled, and not especially flexible once you’re out there hopping islands. Miss a boat connection or get sidelined by illness, and the rebooking options can be limited and expensive. Insurance matters because the logistics are a chain, and one broken link can shake the whole trip.

5. Kilimanjaro (Tanzania)

Kilimanjaro is a high-altitude climb that draws plenty of first-timers, which is part of its appeal and also part of the risk. Altitude illness, injuries, or severe dehydration can escalate quickly, and evacuation support is not the same as strolling into an urban urgent care. Coverage that explicitly includes hiking at altitude is the kind of fine print that suddenly becomes very loud.

6. The Sahara Desert (Morocco)

Desert trips often look smooth on social media, with soft dunes and mint tea, yet they’re built on vehicles, guides, and long distances from medical care. Heat illness and accidents do not pair well with remoteness. Even when everything goes well, delays and changes can ripple through tight schedules and pre-paid arrangements.

7. Iceland In Winter

Iceland is a dream in winter, and it can also turn into a lesson in wind, ice, and rapidly changing road conditions. Road closures can strand you far from your next booking, and rental car issues can pile up fast if the weather keeps moving the goalposts. Trip interruption coverage feels especially relevant when your itinerary is basically a string of nonrefundable nights.

Nicolas J Leclercq on Unsplash

Nicolas J Leclercq on Unsplash

8. New Zealand’s South Island

New Zealand makes it easy to get brave, with hiking, bungee jumping, rafting, and long scenic drives that encourage you to keep going just a bit farther. Adventure activities often carry exclusions unless you choose a policy that covers them, and that detail matters more here than in a museum-heavy city break.

9. The U.S. (For Visitors From Abroad)

The U.S. is not a remote destination, yet medical care can be expensive enough to turn a simple emergency into a financial shock for travelers. Even a short hospital visit can be a major bill, and many visitors discover too late that their home coverage does not travel well. This is the classic case where insurance is less about drama and more about protecting yourself from the price tag.

10. The Swiss Alps During Ski Season

Ski trips are fun until they aren’t, and even minor injuries can mean mountain clinics, ambulance transport, and missed prepaid lodging. Weather can also shut down lifts, roads, and connections, which is how a planned weekend turns into unexpected extra nights. Insurance is especially useful when a trip includes both physical risk and rigid booking costs.

Nirmal Rajendharkumar on Unsplash

Nirmal Rajendharkumar on Unsplash

11. The Canadian Rockies In Shoulder Season

Shoulder season is gorgeous and quieter, and it comes with fickle conditions that can swing from mild to wintery with very little warning. Trail access changes, roads can surprise you, and travel plans can wobble around weather you didn’t expect to matter. Coverage helps when flexibility is limited by geography and timing.

12. Alaska

Alaska offers wild scale, long distances, and excursions that can take you well away from quick help. Boat tours, small-plane trips, and remote lodges are part of the magic, and they also make cancellations and medical events more complicated. If you’re going far from major services, evacuation benefits stop sounding abstract.

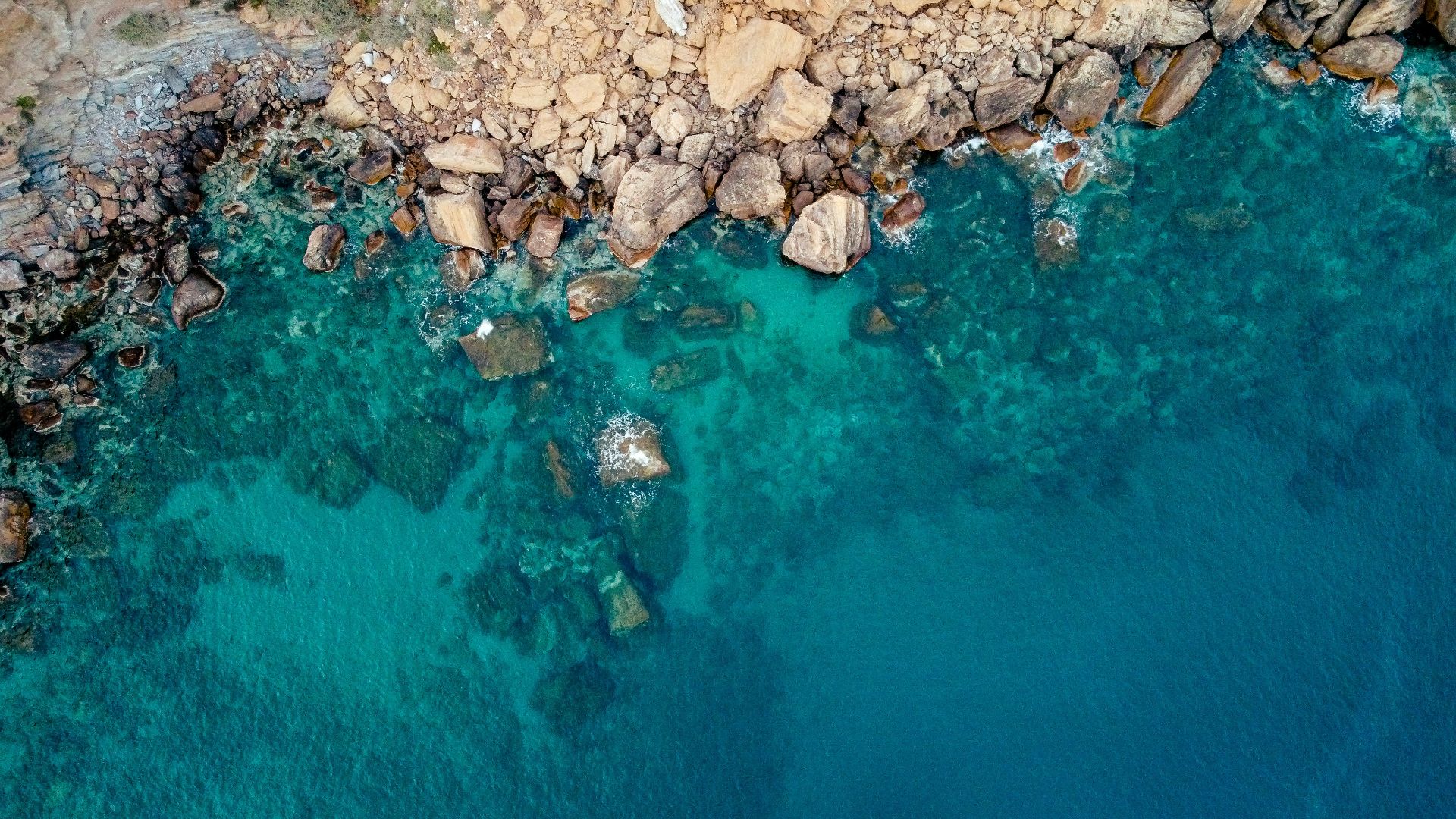

13. The Greek Islands

Island-hopping sounds breezy until the ferry schedule shifts, the wind kicks up, or a strike changes the day’s plan. When your trip depends on a chain of connections, missing one can cascade into lost reservations and pricey rebooking. Insurance matters here because logistics are the real terrain.

14. The Philippines

The Philippines can involve domestic flights, ferries, and long drives that look simple on a map and behave differently in real life. Weather can interrupt travel, and medical resources vary widely depending on where you are. A policy that covers delays, cancellations, and medical transport can save a lot of scrambling.

15. Indonesia

Bali itself is well-traveled, but many itineraries extend into areas where transportation is less predictable and medical care is less straightforward. Volcano activity and weather can also disrupt plans, and adventure add-ons like scooters and diving introduce their own risk categories. Insurance matters because the trip often mixes leisure with genuinely higher-stakes logistics.

16. Costa Rica’s Rainforests And Coasts

Costa Rica is built for zip lines, surf lessons, jungle hikes, and those slippery little footbridges everyone pretends are easy. Injuries are common enough in adventure travel that coverage for activities and medical visits tends to pay for itself if you’re unlucky. Rainy season can also rearrange road access and schedules in ways that get expensive quickly.

17. Egypt

Egypt trips often involve guided segments, flights that connect tight, and prepaid tours where missing a day is not easily replaced. Heat, stomach issues, and travel disruptions are common enough that medical and interruption coverage becomes a practical safety net. When the trip is a stitched-together itinerary, you want protection for torn seams.

18. India During Monsoon Season

Monsoon travel can be incredible, and it can also mean delays, flooding, and sudden changes to transport plans. Even in big cities, disruptions can ripple outward, and in smaller areas the challenge is often simply getting from one place to another. Insurance helps when weather is not a background detail but a controlling character.

19. The Caribbean During Hurricane Season

A Caribbean trip can be perfect and still get knocked sideways by a storm that shifts your flights, closes hotels, or changes cruise routes. The financial pain often comes from last-minute rebooking and lost nights, not just the weather itself. This is one of the clearest cases where cancellation and interruption coverage can turn chaos into inconvenience.

20. The Schengen Area

For travelers who require a Schengen visa, travel medical insurance is often part of the paperwork, and it needs to meet specific minimum coverage rules. Even beyond the visa requirement, multi-country trips make missed connections and medical surprises more complicated to handle on the fly. When bureaucracy is part of the entry ticket, insurance stops being a nice-to-have and becomes part of the trip’s foundation.